Reconciling expenses and sales does not have to be challenging at times. Projects in the construction industry can vary from small to large, in terms of size, or weeks to months, in terms of timeframe. This type of business is different from other industries such as restaurants, retail, or non-profit organization. Thus, it is important for new business owners and managers to use an accounting method that fits their business model.

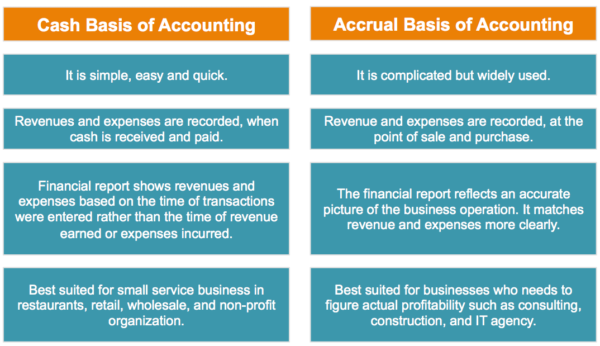

By understanding the basics of the two principal methods of keeping track of a business’s income and expenses for a service: cash method and accrual method (sometimes called cash basis and accrual basis) will allow business owners and project managers determine the success and financial health of their projects.

“In a nutshell, these methods differ only in the timing of when sales and purchases are credited or debited to your accounts.”

Using the cash basis accounting for project based or service business such as general contractors, electricians, plumbers, HVAC, and engineering solution business will mislead the performance of your projects.

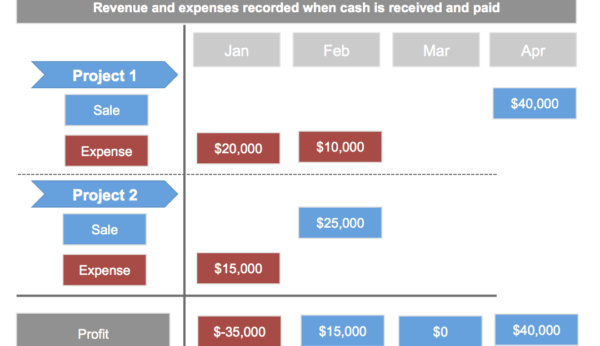

If you use the cash method, income is counted when cash (or a check) is actually received, and expenses are counted when actually paid. Often, this can be chaotic during reconciliation on the books.

Purchase for a material or subcontracting a portion of the project to a licensed contractor will have a different interpretation between these two methods. The benefit of this method allows for the real visibility of current cash in your banking account. However, after the completion of the project, we generally bill our clients and the payment from them can range from 1 month to 6 months, depending on the agreement with the client. It is difficult to close the project and books at the same time with accounting since expenses and bills are waiting to be recorded. In this case, we are not only able to close the project after the project is immediately completed, but also unable to figure the expense of our project on timely matter to our stakeholders. The pitfall of this approach is the lack of determining the profitability at real time from the project.

“But under the more common accrual method, transactions are counted when they happen, regardless of when the money is actually received or paid.”

As business owner, our goal is to ensure all project is profitable. In the construction industry the visibility of the profitability of project becomes very deem when using the cash method.

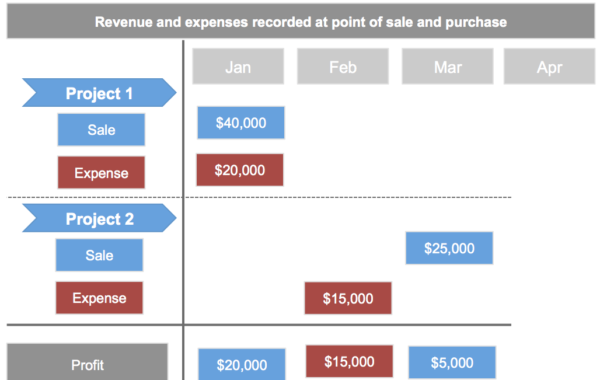

When using an accrual method, income is counted when the sale occurs or billed, and expenses are counted when you receive materials to use for the project. You don’t have to wait until you see the money or until you actually pay money out of your checking account. This gives you a clearer picture of financial health of your company. The benefit of this approach allows for further analyze on whether these types of projects are profitable as well as tracking the expense during the actual transaction date rather than waiting more than a month to reconcile it.

Whichever method you use, it’s important to realize that either one gives you only a partial picture of the financial status of your business.

“The accrual method shows the flow of business income and debts more accurately.”

Some critique say using the accrual method may leave you in the dark as to what cash reserves are available, which could result in a serious cash flow problem. For instance, your income ledger shows thousands of dollars in sales, while in reality your bank account is empty because your customers haven’t paid you yet. And though the cash method will give you a truer idea of how much actual cash your business has, it offers misleading picture of longer-term profitability.

Instead, we at Profit Pad use an accrual basis method and implement a Cash Flow Statement to help our clients figure out their actual profitability and cash on hand so that they can avoid losing attention of their cash reserves resulting a disruption to their operations.

For additional information about the cash flow statement template or accrual basis method, please feel free to contact us at [email protected] and one of our account managers will send you an example of our template.

Signup today!

By clicking ‘Subscribe”, I agree to Profit Pad’s Terms & Privacy Policy.