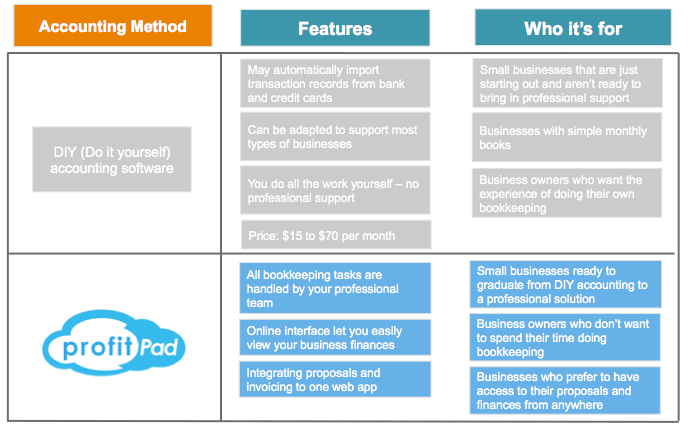

Most general contractors and new business owners in the construction field will tend to use Quickbooks as a tool for Do It Yourself (DIY) in their early stage. Quickbooks is very affordable software for new business owner and growing business, however, the application tend to be cumbersome for business owners with limited knowledge of accounting. As a result, there are many negative feedbacks from the steep learning curve of the software.

Whether you’re just starting your business and need a bookkeeping solution, or you’re a grizzled QuickBooks vet looking to spend less time in front of your computer, we’ll show you how DIY bookkeeping and outsourcing to a bookkeeping company.

DIY accounting software

When you start a new business, DIY accounting software in the market is the first place to turn to. Be advised, not all-accounting software are created equal. Quickbooks is relatively inexpensive, and includes tools that let you take personal control of your business finances, no matter what type of business you’re in. But you’ll need to manually reconfigure the software for your business which takes a lot of trial and error or hire a Quickbooks specialist to help you setup the software. Quickbooks is design for general business rather than businesses with project based services.

On the other hand, you can purchase Timberline Sage software, a software made for businesses in the construction industry, but the price is very expensive for small businesses to adopt.

Features

Automatically imported transactions

Most software allows you to import transactions from your bank accounts or payment services. This lets you categorize transactions, and track your income and expenses.

This automatic importing speeds up the process of doing your books, but the most essential part of bookkeeping is still in your hands. It’s up to you to set up categories for expenses, and then assign them to each transaction. In addition, for any transaction associated with a project cost, you will have to reassign each transaction to a job order or purchase order.

Categorizing your own transactions

The tools in DIY accounting software let you set up a chart of account for your business. The chart of accounts is used to categorize every transaction you carry out. Most software comes with presets to suit certain industries.

That being said, if you want to guarantee your ledger is set up correctly, you’ll need help from a CPA. Furthermore, the construction industry is quite complicated due to the job costing method. Otherwise, you could end up going through a whole financial year on your own before discovering, at tax time, that your categories are set up incorrectly.

Also, the amount of tweaking you may need to do—and the number of hours your CPA will clock—depends upon how complex your business is. More categories means more work.

Automatic financial reporting

Accounting software can also prepare financial reports automatically. That means you get a balance sheet, income statement, or cash flow statement for your business at the end of the month, usually with just a couple of clicks.

But that statement will only be as reliable as the information you’ve already entered. If you’ve miscategorized transactions—or if some of them failed to import, and you didn’t enter them manually—you’ll end up with inaccurate financial reports.

The drawbacks of DIY

The biggest shortcoming of DIY accounting is that you don’t get any professional help.

That can mean a few things for your business.

Time spent on bookkeeping

With DIY, you do 100% of your own bookkeeping. So, you need to be ready to put aside a certain amount of time every week to take care of your books. Whether you’re willing to do this likely depends on how many other business tasks you’ve got on your plate.

Frustration

Software like QuickBooks comes with a learning curve. If you don’t spend some serious time with QuickBooks tutorials, brace yourself for frustration. Especially when you’re starting out, it can take a lot of time and energy getting categories set up and figuring out what you need to do to get accurate financial reports. Learning accounting principles and applying it to your business model can be very complex and time consuming. If you already find aspects of running your own business stressful, this only adds to the problem.

Price of extra help

If you make mistakes setting up your chart of accounts or categorizing transactions, you could end up with a mess of inaccurate bookkeeping—a mess that only a professional can untangle. Hiring a CPA or a bookkeeper to fix errors will cut into money you initially save by using a DIY solution.

Danger of errors

If you file your taxes using inaccurate financials, you could end up paying the IRS fines. And if you make business decisions based on inaccurate financials, you could make pricey mistakes, such as overdrawing from your accounts. Without professional support, there’s no way to guarantee there won’t be errors in your books. You’re completely on your own—and you’ll have to bear the consequences of any mistakes you make.

Price

The cost of DIY accounting software, relative to hiring a bookkeeper, makes it pretty attractive at first glance. For instance, Xero starts at $9 per month for a “Starter” package, ranging up to $70 for “Premium.”

When comparing bookkeeping solutions, though, it’s important to factor in the cost of your own time. So, for instance, if Quickbook online is going to cost you $15 per month, how much time will you spend using it per month—and how much is your own time worth?

Let’s say you value your time at $40 per hour. Then, let’s say you spend eight hours a month doing your own bookkeeping. That’s $320 worth of labor. Plus $15 for the subscription.

So you’re still paying $335 per month for bookkeeping. This could be an incentive for getting better at bookkeeping, so you spend less time per month doing it. Or it could be a sign you need to outsource the job.

Who it’s for

DIY accounting software is a fine place to start if you’re just getting your business off the ground and need a quick and dirty solution. It will give you the tools you need to track money entering and leaving your business, and keep records.

The DIY route also makes sense if you have some background in business bookkeeping, and there’s space in your schedule to make bookkeeping a regular task.

Doing your own books comes with some great benefits if you are a disciplined person who can stay on top of it. You’ll know your own finances inside out, and if you do hand off the books to a pro at a later date, you’ll get more value out of the financial statements they provide you.

As your business becomes larger and more complex, however, you’ll find the time you spend bookkeeping begins to pile up. Taking into account the value of your own work hours, you’ll know when it’s time to move to professional help.

Profit Pad

Overview

Once you sign up with Profit Pad, you not only get a team of bookkeepers who handle your day-to-day bookkeeping tasks, but also professional who understands the project management principles.

Your team adapts to your business: When you’re first getting started with Profit Pad, your account manager will work with you to figure out how certain expenses should be categorized.

The Profit Pad app lets you track your finances with visual reporting. You also get the key financial reports you need to track how your business is performing. The app also offers tools such as proposal and invoicing where you can keep track of your billing and attached important documents.

The main difference between Profit Pad and traditional accounting software is that Profit Pad isn’t DIY. We literally handle your bookkeeping for you. That takes hours or days of bookkeeping out of your schedule, and ensures all your books are error-free.

Features

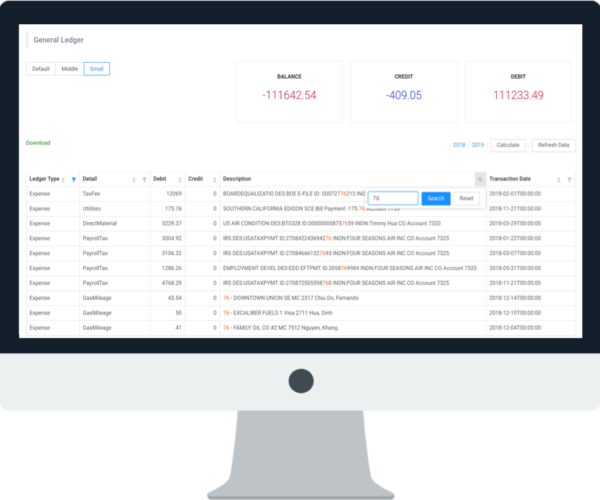

Transaction categorized by your bookkeeper

Your Profit Pad team does all the categorizing for you, and sets up your ledger too.

Right after you start out with Profit Pad, your team may have a few questions about how certain expenses should be categorized. If they’re not sure how a specific transaction should be categorized, they’ll message you for your input. As a result, you will be to find, filter, and search those transactions by charted account and name from the ledger.

The more time your team spends working with you, the better they’ll learn your books—and the less they’ll email you with questions.

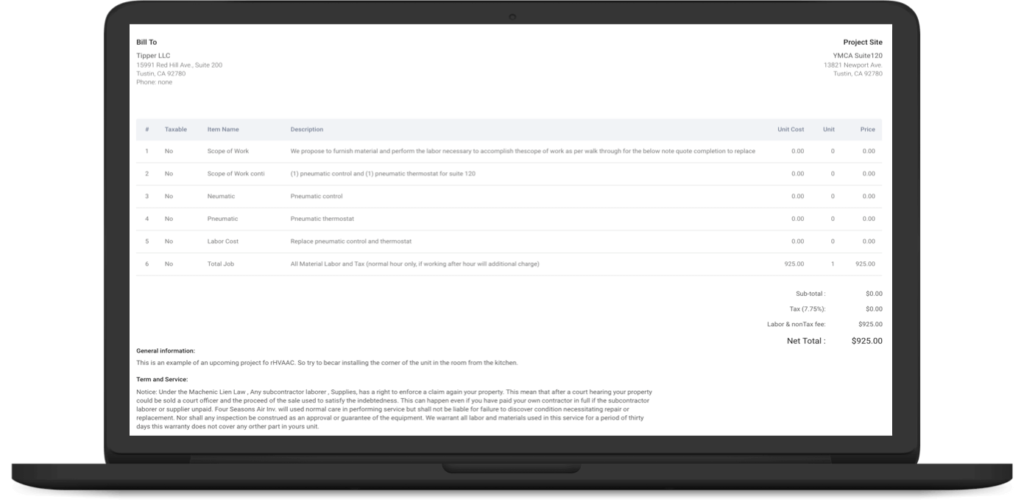

Send proposal and digital approval request

We understand time is the most valuable component for small businesses. Sending request through an online digital approval proposal will bring an outstanding and professional impression to your client. Also, this process allow you and your team from printing and scanning documents, resulting saving valuable time with a single click from our web application. It ensures all proposals are approved before you take action and come to the job site for inspection.

Integrating proposal and invoice in our app

Profit Pad is not just a bookkeeping service or app but we see ourselves as a valuable partner to your business. Most construction business owners tend to spend a lot of time with generating proposals for clients from 3rd party solutions such as Microsoft word, Quickbooks, or excel. So we created features allowing our customers to create and edit proposals / invoices from anywhere while having access to their books. We understand the importance of safeguarding and centralizing your important billing in one central location.

Furthermore, our team will work with you or your team organizing and uploading your receipts into our secured cloud. By keeping records of your invoice or bills from your vendor, you will be able to use them in the near future for creating proposals.

All the financial insight you need

Profit Pad gives you monthly financial statements, including your income statement, cash flow, and balance sheet. And the Profit Pad app automatically generates visual reports, so you can get a clearer sense of how your business is performing than you would by looking at a sheet of numbers.

At the end of the year, Profit Pad prepares a Year End Financial Package, which has all the financials your accountant needs to file your taxes. You can also request permission to have your accountant log in to your Profit Pad account, and have a look themselves.

Price

Broadly speaking, Profit Pad costs more than paying for accounting software, but less than hiring a traditional bookkeeper or account manager.

Packages start at $99 per month for “Micro” (businesses with monthly expenses under $7,000), ranging up to $385 per month for the largest “Corporate” businesses with monthly expenses of $1 million.

Who it’s for

Profit Pad is a good choice if you’re upgrading from DIY bookkeeping, but your business isn’t big enough to bring on a full time bookkeeper or your company does not have a qualified bookkeeper. If you’re uncomfortable taking care of business or have issue with hiring bookkeeper as an employee for your company – Profit Pad is a natural fit for you.

Your business is an especially good fit for Profit Pad if you already have some revenue momentum, and use accrual or cash accounting.

There are a few types of businesses that aren’t a good match for Profit Pad, though. If your business has over $5 million annually in revenue, you might be better off hiring a bookkeeper as an employee.

Fantasize about having someone else do your bookkeeping? Get a better idea of whether Profit Pad is the right solution with an inside look at how Profit Pad does your bookkeeping.

Subscribe to our monthly newsletter

By clicking ‘Subscribe”, I agree to Profit Pad’s Terms & Privacy Policy.