as easy and transparent

as payroll’s ever going to be

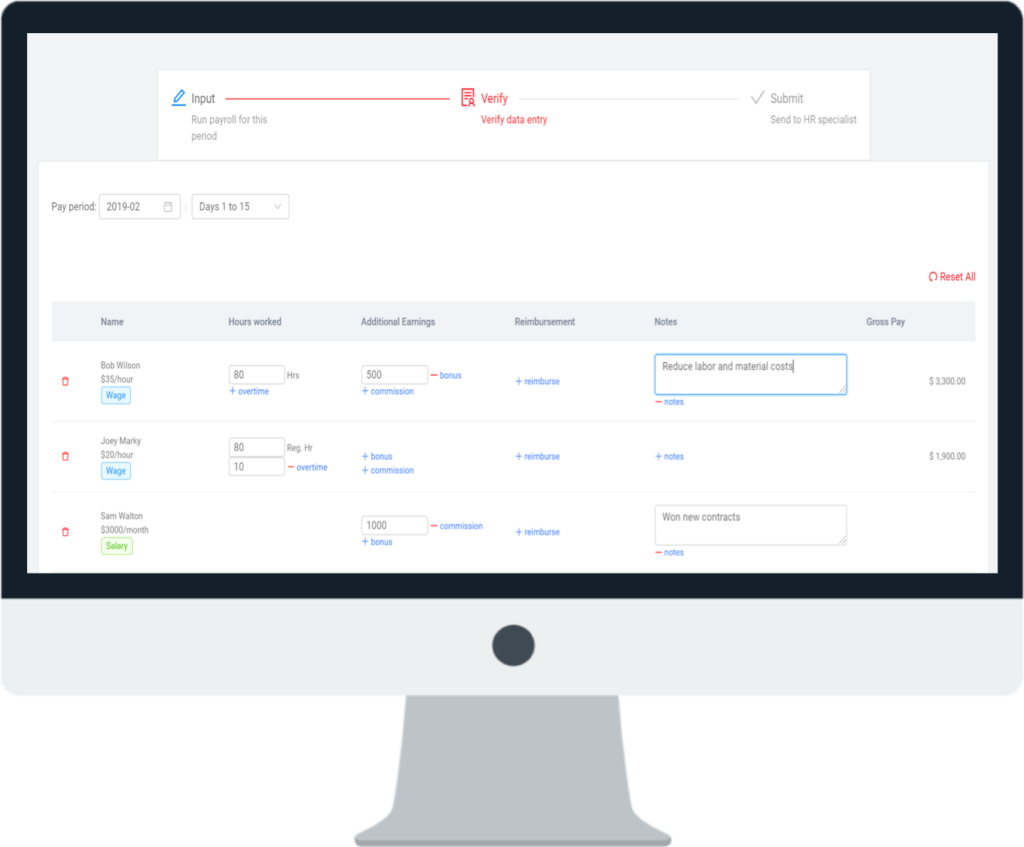

We only let you input your employee(s) time sheets or send us those hours. Our payroll specialists will review the Federal and State tax computation. The process is very easy and take less than 3 minutes through our platform.

We're more than standard payroll - HR

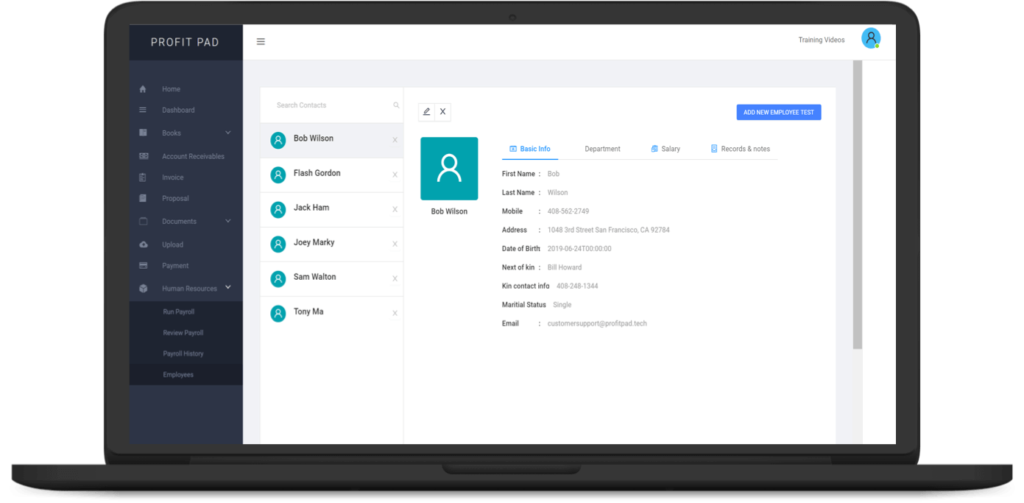

HR – Personnel record tracking

As a general contractor or office manager, you will be able to keep track of important HR documents of your employee(s) on Profit Pad portal. Our service includes access to employee information, payroll stubs, and upload documents such as employment agreement and performance reports.

What we do each month

Run Payroll

Process timesheets in less than 3 minutes from our proprietary software, or have your team send timecards to us.

Review and Approval

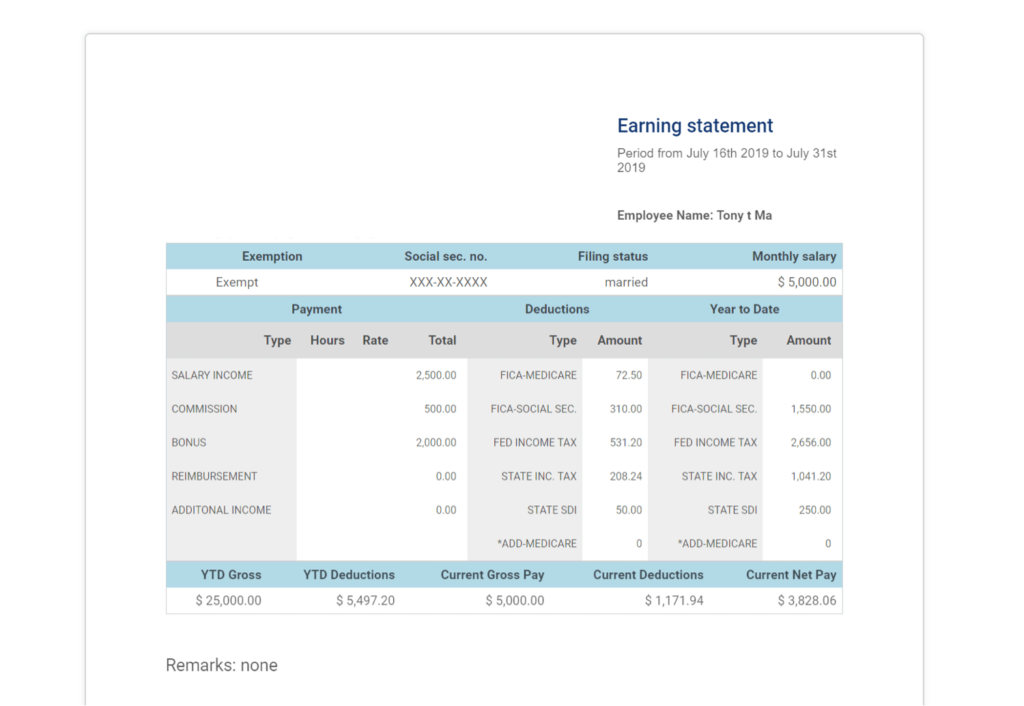

We turn complex to simple tax calculations and ready for approval. We even handle your W-2s and tax filings to make sure everything is accurate and on time.

Payroll record keeping

Once payroll period is approved, we’ll make an ACH transfers or prep checks. Your records our securely stored in our cloud.

Full-service payroll

It’s all online and flexible for your needs, including:

- Federal and local taxes

- Automated payroll filings and ready tax payments

- Unlimited payrolls

- W-2s and 1099s

- Multiple schedules and pay rates

- Online employee setup

Accounting integrations

Integrate your accounting with Profit Pad bookkeeping service to automatically sync expenses and hours.

Employer self service

You get lifetime access of your employee(s) pay history and W-2s, and can update their own information from anywhere—which means you don’t have to be at the office.

What Are You Waiting For? Start today and ask for a free quote!

Sign up for 1 month free trial, and get access to Profit Pad.

We’ll produce payroll report for any month or period you choose.

No credit card required. By clicking “Start Your Free Trial”, I agree to Profit Pad’s Terms & Privacy Policy.